Why We Pick Sides Over Nothing: Instant Tribalism Science

TL;DR: The endowment effect causes people to overvalue things simply because they own them. This ancient cognitive bias affects everything from daily purchases to major investments, creating a gap between what sellers demand and buyers will pay. Understanding this bias helps recognize when ownership clouds judgment.

You've probably experienced this: You list something for sale online, price it at $50, and buyers balk. Yet you'd never pay that much yourself if the roles were reversed. Or you hold onto that losing stock because selling feels like admitting defeat, even though you'd never buy it at today's price. Welcome to the endowment effect, a cognitive bias so powerful it distorts our valuation of everything from coffee mugs to million-dollar portfolios.

The endowment effect is deceptively simple: people assign greater value to things merely because they own them. Once something becomes "mine," its perceived worth inflates, often dramatically. This isn't about sentimental attachment to grandma's necklace - it happens with items we've possessed for minutes, things we never wanted in the first place, even objects we've only imagined owning.

Behavioral economists Daniel Kahneman, Jack Knetsch, and Richard Thaler demonstrated this phenomenon in their now-legendary 1990 mug experiment at Cornell University. The setup was brilliantly straightforward: randomly divide students into two groups, give one group a university mug, and observe what happens when you ask about prices. The owners demanded more than twice what the non-owners were willing to pay for an identical mug. These weren't family heirlooms or rare collectibles - they were ordinary mugs participants had possessed for minutes.

The gap between buying and selling prices revealed something profound about human psychology. Classical economic theory, particularly the Coase theorem, predicted that roughly half the students would want to trade. Instead, only about 10% made exchange offers. Ownership had fundamentally transformed how people valued an object, creating a chasm between what sellers demanded and buyers would pay.

What drives this valuation gap? The answer lies in multiple intersecting psychological mechanisms, each pulling our judgments in the same direction: overvaluing what we have.

Loss aversion provides the foundation. Research by Kahneman and his colleague Amos Tversky showed that losing something feels about twice as painful as gaining the same thing feels good. When you own an item, selling it frames the transaction as a loss. When you don't own it, buying it frames the transaction as a gain. Same transaction, opposite emotional weight.

Loss aversion is the cornerstone: losing something you own feels twice as painful as gaining something new feels good. This asymmetry drives the entire endowment effect.

But loss aversion alone doesn't explain everything. The mere ownership effect kicks in even when loss framing shouldn't apply. Touch a product in a store, and your valuation rises. Imagine owning something, and the same thing happens. Simply perceiving an object as "mine" - even temporarily, even hypothetically - triggers increased valuation.

Two complementary theories explain this mere ownership phenomenon. Attachment theory suggests that ownership creates an emotional bond between you and the object. Once that bond forms, losing the item threatens your sense of self. The alternative explanation, self-referential memory theory, proposes that ownership enhances memory accessibility. Items associated with "me" get processed more deeply and retrieved more easily, creating a cognitive fluency that feels like greater value.

Neuroscience research by Kim and Johnson in 2014 revealed the brain basis for this bias. When people perceive objects as "mine," their medial prefrontal cortex lights up - the same brain region involved in self-referential processing. Ownership literally integrates objects into your neural representation of self. Giving up owned items isn't just losing a possession; it's threatening a piece of your identity.

The endowment effect isn't a modern quirk of consumer culture. It's ancient, widespread, and probably adaptive.

Research by Owen Jones and colleagues discovered that the endowment effect exists not just in humans but also in chimpanzees, orangutans, and gorillas. When primates trade items they own, they show the same reluctance as human participants. More revealing: the effect was 14 times stronger when trading foods versus toys. Items relevant to survival trigger the bias far more powerfully than arbitrary objects.

"Natural selection can bias decision-making toward choices that were rational in ancestral conditions but are mismatched to modern environments, yielding outcomes that are irrational yet predictably patterned."

- Owen Jones, Vanderbilt University Law School

This pattern makes evolutionary sense. For our ancestors, possessions were scarce and hard-won. Food, tools, shelter materials - losing these could mean death. An organism with a psychological mechanism that says "what I have is more valuable than an uncertain alternative" would protect critical resources. That bias kept our ancestors alive long enough to become our ancestors.

Jones and his team developed an "evolutionary salience score" measuring each item's relevance to survival and reproduction. This score predicted more than half the variance in endowment effect magnitudes across different items. Water bottles, food containers, first aid supplies - all triggered stronger endowment effects than items less relevant to ancestral survival challenges. Your brain still treats possessions through the lens of an environment where losing resources could be fatal, even when you're just deciding whether to sell a rarely-used bike.

Marketers understand the endowment effect better than most psychologists. They've turned psychological ownership into a precision instrument for separating you from your money.

The free trial represents the endowment effect weaponized. Sign up, get 30 days free, and marketers know what happens next. You start using the product, it becomes "yours," and canceling now feels like a loss. You planned to evaluate it rationally and cancel before charges begin. But once you're three weeks in, canceling means losing something you've integrated into your routine. Subscription services count on exactly this dynamic - they make cancellation psychologically costly even when it's financially sensible.

The IKEA effect supercharges standard endowment bias by adding effort. Assemble that bookshelf yourself, and you'll value it more than an identical pre-assembled one. Real estate agents encourage buyers to visualize furniture placement and imagine living in a home because mental ownership increases willingness to pay. Car dealerships offer overnight test drives. Software companies provide demo accounts with your actual data. Each tactic creates psychological ownership before legal ownership, making the "loss" of not purchasing feel acute.

Free trials, test drives, and "try before you buy" offers aren't just customer-friendly - they're psychological ownership traps that make not buying feel like a loss.

Return policies work the same way in reverse. "Buy now, return within 60 days" sounds consumer-friendly. It is - but it's also brilliant psychology. Once you've used that jacket for a week, returning it means giving up something that feels like yours. Retailers know most people won't follow through, even when they genuinely planned to evaluate it critically.

Default options leverage endowment bias powerfully. Make organ donation opt-out instead of opt-in, and donation rates soar. People treat the default as their endowment; changing it feels like a loss. Companies use this in everything from retirement plan enrollment to privacy settings. The default position becomes the owned position, and switching away requires overcoming endowment bias.

The endowment effect wreaks particular havoc on investment portfolios, where it compounds other cognitive biases to produce expensive mistakes.

Consider a simple scenario: You bought a stock at $50, and it's now trading at $30. Selling means realizing a loss - not just financially, but psychologically. That stock is yours, part of your portfolio's identity. Giving it up feels like admitting defeat. So you hold, hoping it recovers, even though you'd never buy it at $30 if you didn't already own it.

This "would I buy this now?" question reveals endowment bias in action. If the answer is no, the rational move is to sell and deploy that capital elsewhere. But ownership changes the calculus. The stock you own feels different from the stock you might buy, even when they're literally the same asset at the same price.

Overexposure to losing positions stems directly from this bias. Investors hold underperforming assets because selling triggers loss aversion while holding feels like maintaining the status quo. The endowment effect turns your portfolio into a museum of bad decisions, each position preserved because it's yours.

Self-assembled investment portfolios face an additional challenge: the IKEA effect. Put in hours researching companies, analyzing financials, and building a portfolio, and you'll overvalue your selections relative to identical holdings in an index fund. The effort you invested makes those picks feel special, even when the data suggests otherwise.

"In the mug experiment, students that were given the mug demanded more than twice the price that the students without the mug were willing to pay."

- Daniel Kahneman, Nobel Prize-winning behavioral economist

A field experiment with university students revealed that the endowment effect persists even for risky, ambiguous financial instruments. Researchers assigned exam bonuses randomly - some students got certain point bonuses, others got ambiguous time bonuses. Despite different risk profiles and utility, both groups showed strong reluctance to trade. Only 3 of 33 students offered to exchange their assigned bonus, far below the 50% predicted by rational choice models. Ownership created attachment regardless of the instrument's characteristics.

The endowment effect doesn't just affect individual decisions; it shapes interactions between buyers and sellers, creating predictable friction in negotiations.

When you're selling your car, it's loaded with memories, perfectly broken-in, exactly configured to your preferences. Potential buyers see a used vehicle with unknown history and inevitable maintenance costs. Same car, radically different perspectives. The gap between what sellers demand and buyers offer often has less to do with objective value than with the psychological distance between owning and not owning.

Salary negotiations carry the same asymmetry. Once you accept a job at a certain salary, that becomes your endowment. Future raises feel like gains, but pay cuts - even temporary ones during hard times - feel like devastating losses. Companies that want to reduce costs find laying people off easier than reducing everyone's salary by 10%, even when the latter might save more jobs. Ownership of your current salary creates a reference point that's painful to move below.

Real estate transactions showcase endowment bias at industrial scale. Homeowners consistently overvalue their properties relative to comparable sales, seeing unique features and remembering investments buyers can't perceive. The median gap between listing prices and eventual sales prices reflects not just negotiation tactics but genuine psychological inability to value your home as others do.

Interestingly, one study found potential gender differences in the strength of the effect. Female participants exhibited swap rates closer to rational predictions for ambiguous items compared to male participants. The researchers suggested women might evaluate ambiguous risks with less attachment bias, though this finding requires replication and further investigation.

Awareness helps, but overcoming the endowment effect requires specific techniques because the bias operates partly below conscious awareness.

The "would I buy this today?" test provides a practical debiasing tool. For every asset you own - stock, car, subscription service, whatever - ask yourself: If I didn't own this and had the cash equivalent instead, would I choose to buy it right now at current prices? If not, that's endowment bias talking. The item hasn't changed value; your ownership has changed your perception.

Ask yourself: "If I didn't own this and had the cash instead, would I buy it today at current prices?" If the answer is no, you're experiencing endowment bias.

Distance yourself from the decision by considering the alternative. A 1995 study by Hirt and Markman showed that actively generating alternative scenarios significantly reduces cognitive bias. Don't just evaluate whether to keep the stock - explicitly consider what else you could do with that capital and write down those alternatives. The act of generating options counteracts the default bias toward keeping what you have.

Implement mechanical decision rules before ownership creates bias. Decide in advance: "I'll sell any stock that drops 15% from purchase price" or "I'll evaluate all subscriptions quarterly and cancel any I haven't used in 30 days." Pre-commitment removes decision-making from the moment when endowment bias is strongest. One financial advisor recommends immediately investing any bonuses rather than spending them, creating cognitive distance from the feeling that the money is truly "yours" to lose.

Improve financial literacy and metacognition - thinking about your thinking. Understanding how the endowment effect works provides some protection, but combining that knowledge with regular reflection on your decision processes proves more effective. Keep a decision journal noting why you're holding or selling. Reviewing past decisions reveals patterns of bias you can then interrupt.

Reframe ownership temporarily. When evaluating whether to keep something, imagine you've already sold it and now must decide whether to buy it back. This mental flip disrupts the default ownership frame, letting you evaluate value more neutrally.

Organizations can design better incentive structures by accounting for endowment bias. One teacher bonus program paid 50% upfront but required repayment if performance targets weren't met. The group facing potential loss significantly outperformed teachers who received bonuses only after meeting goals. Framing the incentive as an endowment to be protected rather than a reward to be earned leveraged loss aversion productively.

While the endowment effect appears in multiple cultures and primate species, its strength varies across contexts in revealing ways.

Collectivist versus individualist cultures show interesting differences. Some research suggests the effect may be weaker in East Asian contexts where self-concepts are more interdependent and boundaries between self and others more fluid. If ownership derives part of its power from integration with self-concept, cultures with different self-construals might show different endowment patterns. However, this research is still developing, and the effect clearly appears across diverse populations.

The evolutionary salience findings suggest built-in variation: items more critical to survival trigger stronger effects regardless of culture. A water bottle in a survival context probably creates similar endowment effects in Tokyo and Toronto, even if cultural factors modulate the bias for other items.

Market experience provides partial protection. Professional traders and people who buy and sell frequently show somewhat reduced endowment effects compared to occasional buyers. Repeated exposure to transactions makes the act of buying and selling feel less like gaining and losing, more like routine exchanges. This suggests the bias can be partially overcome with practice and professional framing.

The nature of the good matters. Endowment effects are generally weaker for money than for goods, and weaker for goods designed for exchange than for personal use items. The effect also diminishes when transaction costs are truly zero and when people expect to trade immediately rather than keep items.

Understanding the endowment effect matters more as our economy increasingly relies on psychological ownership without legal ownership. Subscription services, sharing platforms, and digital goods all create ownership feelings without traditional property rights. Your Spotify playlists, Netflix queue, and cloud storage feel like possessions even though you're renting access. Companies engineer these feelings deliberately, knowing psychological ownership drives retention.

Artificial intelligence and algorithmic trading present an interesting test case. Can automated systems free from endowment bias outperform human investors? Early evidence suggests yes - algorithms that mechanically follow rules like "sell positions that fall below X" avoid the emotional attachment that makes humans hold losers too long. But humans must still set the rules, and bias can creep in through which algorithms we trust and how we frame their recommendations.

Policy design increasingly incorporates endowment insights. Opt-out retirement savings, default organ donation, and pre-checked privacy settings all use default positions as endowments to nudge behavior. The ethics of these interventions remain contested - are we helping people overcome bias or manipulating their psychology? The same mechanism that causes people to overpay for things they own can be leveraged to increase retirement security.

Perhaps most importantly, recognizing the endowment effect as a feature of human psychology rather than a bug or moral failing changes how we approach decisions. You're not irrational for overvaluing what you own; you're human, carrying cognitive tools shaped by millions of years where loss of possessions meant death. The goal isn't to eliminate the bias - that's likely impossible - but to recognize when it's helping and when it's hurting.

Next time you're deciding whether to keep that stock, cancel that subscription, or sell that barely-used equipment, pause and ask: Am I valuing this based on its actual usefulness and alternatives, or just because it's mine? The answer might save you money, clear out your closet, and help you make decisions aligned with who you want to be rather than what you happen to own.

The endowment effect reveals a profound truth: ownership isn't just a legal status or economic relationship. It's a psychological state that reshapes perception, restructures memory, and literally changes your brain's processing of value. Understanding this doesn't make you immune - but it gives you a fighting chance to recognize when your "mine" is worth more in your mind than in the market.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

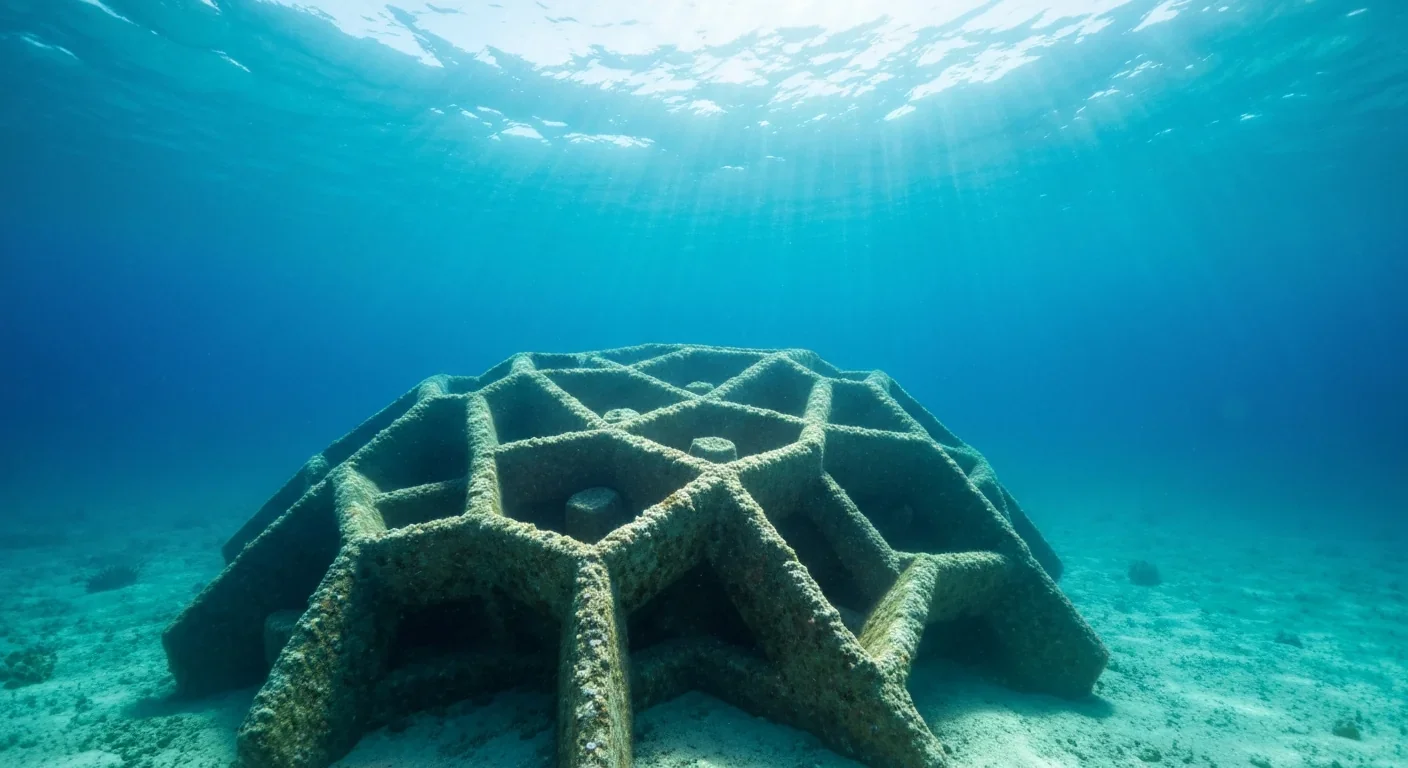

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

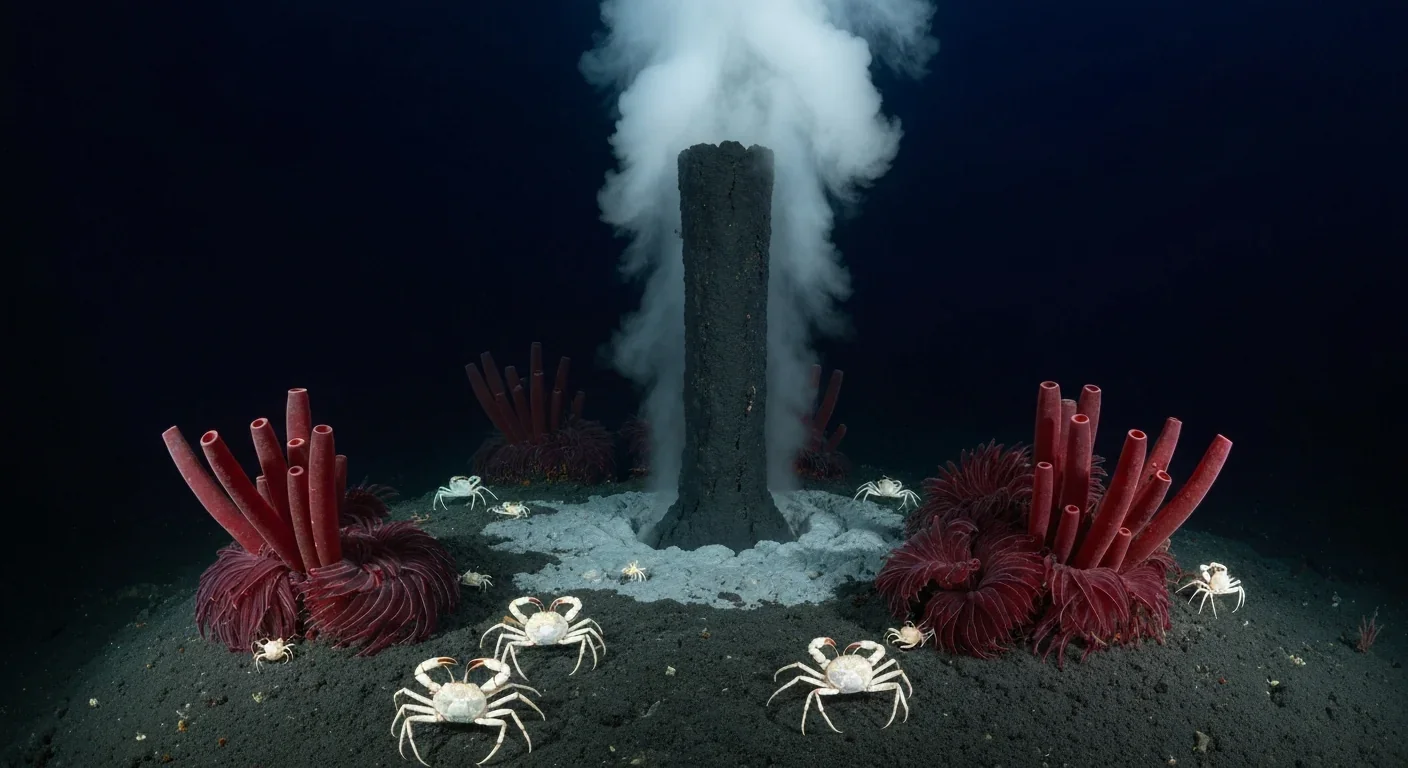

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.